49+ is mortgage interest on a second home deductible

Homeowners who bought houses before. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Four Corners Real Estate Guide Winter 2020 By Ballantine Communications Issuu

Deductible real property taxes.

. Lock Your Rate Today. Web Mortgage interest Property taxes If you rent out the place Click to expand Mortgage interest If you use the house as a second homerather than renting it. Apply Directly to Multiple Lenders.

Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

You filed an IRS form 1040 and itemized your deductions. Find A Lender That Offers Great Service. Get Instantly Matched With Your Ideal Mortgage Lender.

Web The mortgage interest deduction is a tax incentive for homeowners. Web Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare. Comparisons Trusted by 55000000.

This itemized deduction allows homeowners to subtract mortgage interest from their taxable. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. Explore 2nd Mortgage Loan Rates from Top-Rated Lenders.

Compare More Than Just Rates. See what makes us different. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

We dont make judgments or prescribe specific policies. Ad 10 Best House Loan Lenders Compared Reviewed. The maximum amount you can.

Make an Informed Decision. Ad Check out Pre-qualified Rates for a 2nd Mortgage Loan. Web If you pay 10000 or more in property taxes on your first home you likely wont be able to deduct any of the property taxes from your second home.

Web As noted in general you can deduct the mortgage interest you paid during the tax year on the first 1 million of your mortgage debt for your primary home or a. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web Mortgages used to buy a primary home or second home including refinanced mortgages Important rules and exceptions.

If you rent out your second. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

424h

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Deduct Mortgage Interest On Second Home

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Pdf Sovereign Credit Ratings And The Transnationalization Of Finance Evidence From A Gravity Model Of Portfolio Investment

Can I Deduct The Interest On A Second Home

3 Things You Need To Know About Second Home Tax Deductions

Second Homes And The Mortgage Interest Deduction Brighton Jones

Can You Deduct Mortgage Interest On A Second Home Moneytips

Nord Lb Group Annual Report 2007 Pdf 1 8

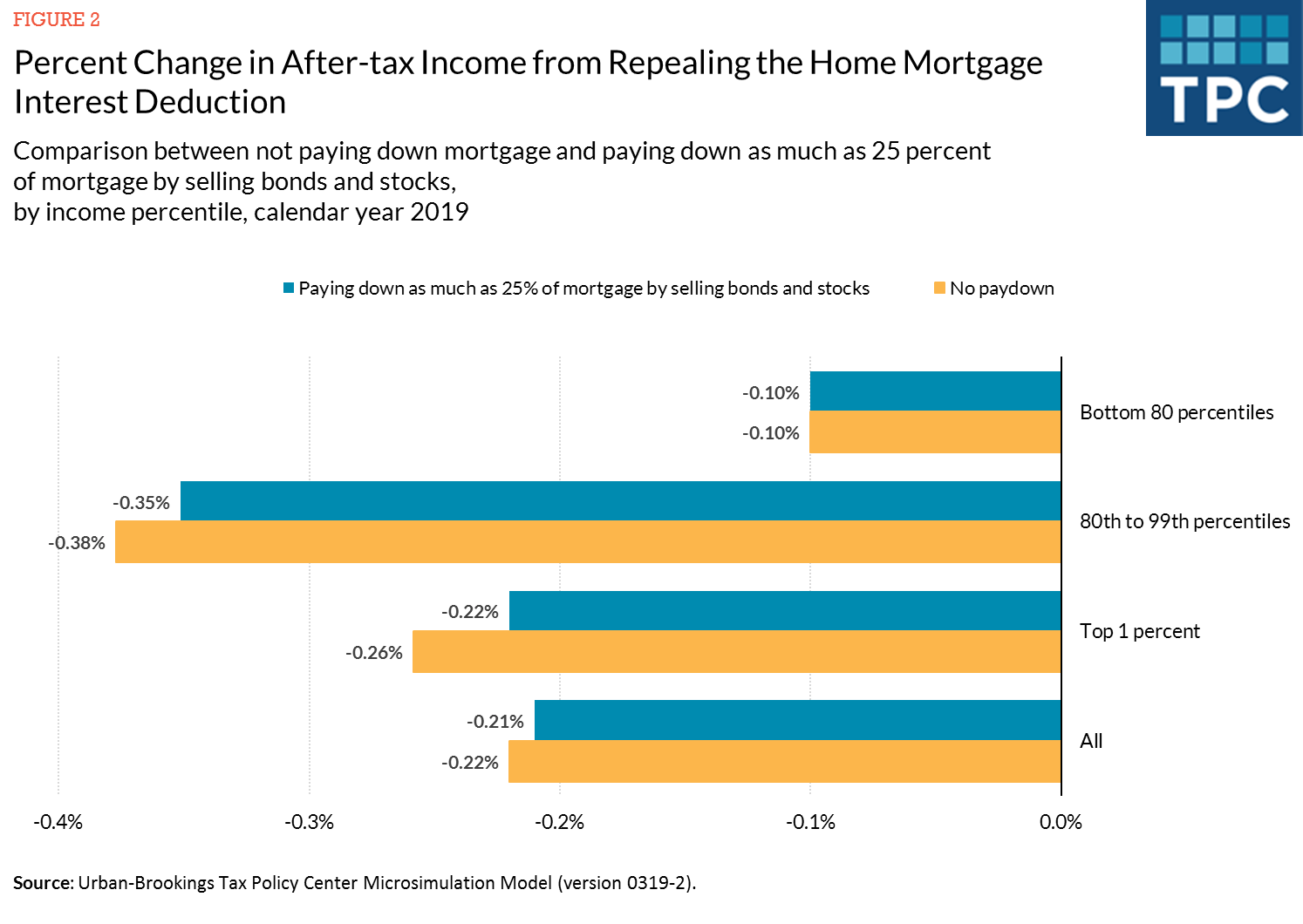

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Business Succession Planning And Exit Strategies For The Closely Held

Can You Deduct Mortgage Interest On A Second Home Moneytips

Fixed Rate Mortgage Wikipedia

Are Second Mortgages Tax Deductible The Tipton

Can I Deduct The Mortgage Interest On A Home I Own In Which A Family Member Lives

Mortgage Interest Tax Deduction What You Need To Know